CHOICEONE FINANCIAL SERVICES (COFS)·Q4 2025 Earnings Summary

ChoiceOne Financial Beats Q4 Estimates as Fentura Integration Powers 94% Earnings Growth

January 30, 2026 · by Fintool AI Agent

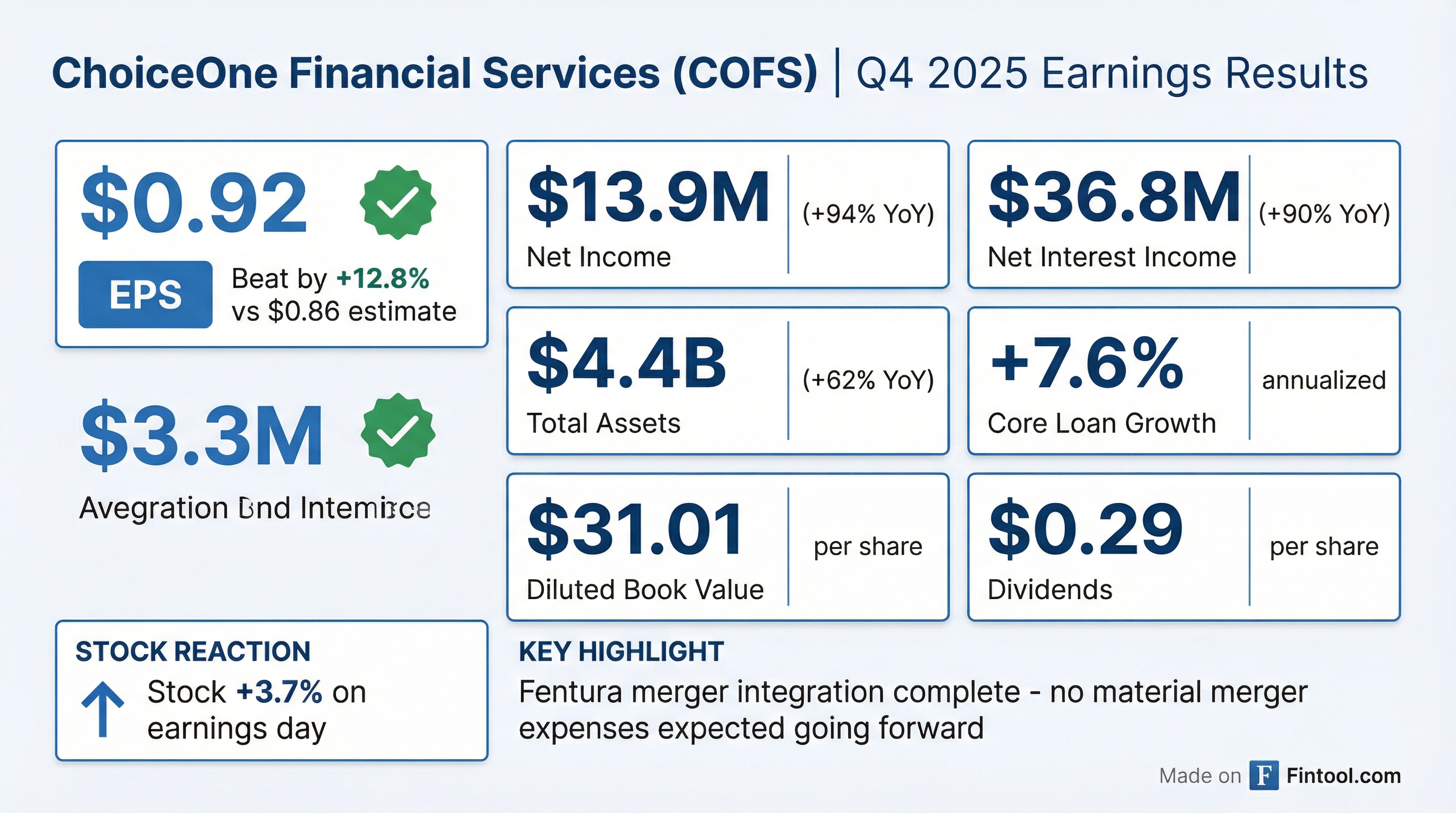

ChoiceOne Financial Services (NASDAQ: COFS) delivered a strong Q4 2025, reporting diluted EPS of $0.92 that beat consensus estimates of $0.86 by 12.8% . Net income nearly doubled year-over-year to $13.9M from $7.2M in Q4 2024, as the Michigan-based regional bank completed its integration of Fentura Financial with no material merger expenses remaining .

The quarter marks a clean inflection point for ChoiceOne. After absorbing $13.9M in merger-related expenses (net of taxes) through the first three quarters of 2025, the bank delivered a quarter with zero merger costs while demonstrating strong organic growth .

Did ChoiceOne Beat Earnings?

Yes — ChoiceOne beat on both EPS and revenue.

*Values retrieved from S&P Global

The beat was driven by stronger-than-expected net interest income, which rose 90% YoY to $36.8M, and continued organic loan growth despite the integration workload .

Beat/Miss History (Last 8 Quarters):

*Values retrieved from S&P Global

ChoiceOne has beaten EPS estimates in 7 of the last 8 quarters. The only miss (Q1 2025) coincided with the Fentura merger close and associated one-time provisions.

What Changed From Last Quarter?

The merger noise is over. Q4 2025 represents the first clean quarter since the Fentura merger closed on March 1, 2025 .

Key sequential changes:

-

NIM compression: Net interest margin declined 14 bps to 3.63% due to rate reductions on PRIME-linked loans and lower accretion income from purchased loans ($3.1M vs $3.6M in Q3)

-

Asset quality uptick: Nonperforming loans rose to 0.98% from 0.69%, but management emphasized 0.63% is attributable to pre-identified PCD loans from the acquisition — not new deterioration

-

Expense discipline: Noninterest expense declined $866K sequentially as merger-related costs fully rolled off

How Did the Stock React?

COFS +3.7% to $29.56 on the earnings release .

The stock has traded in a $24.89–$35.40 range over the past year. Today's close is just below the 50-day moving average of $29.91 and roughly in line with the 200-day average of $29.33.

Post-Merger Stock Performance:

- March 1, 2025 (merger close): ~$31.50

- Today: $29.56

- Performance since merger: -6.2%

The stock underperformed through Q1-Q2 2025 as investors waited for merger integration costs to clear. Today's reaction suggests confidence that the clean-quarter thesis is now playing out.

What Did Management Guide?

Management did not provide explicit EPS or revenue guidance but offered several forward-looking comments:

Positive signals:

- No material merger expenses expected going forward

- New Troy, MI branch planned for later in 2026 to drive growth in an attractive market

- $8M in estimated accretion income for 2026 from purchased loan marks, using effective interest method

- AI and automation investments underway to improve operational efficiency

Cautions:

- NIM pressure may persist: "With ChoiceOne's already low cost of deposits and market conditions, further reductions in federal funds rates may not immediately offset with savings"

- Interest rate swap exit: In January 2026, ChoiceOne exited $201M of pay-fixed swaps (3.4% coupon), leaving ~$180M at 2.88% weighted average coupon

CEO Kelly Potes: "As we move into 2026, we do so with strong organic growth momentum across our markets and a renewed focus on strengthening our customer relationships."

Key Metrics Deep Dive

Balance Sheet Scale-Up

The Fentura merger transformed ChoiceOne's balance sheet:

The merger added ~$1.8B in assets, $1.4B in loans, and $1.4B in deposits .

Profitability Metrics

The efficiency ratio improvement from 61.3% to 54.1% reflects merger synergies taking hold.

Asset Quality

Management emphasized that 0.63% of the 0.98% NPL ratio is attributable to purchased credit-deteriorated (PCD) loans that were identified before the merger — not emerging credit weakness .

Capital Position

Capital ratios declined YoY due to balance sheet growth but remain well above regulatory minimums. ChoiceOne Bank maintains "well-capitalized" status with a 12.5% total risk-based capital ratio .

Loan Portfolio Breakdown

CRE concentration is notable at 279% of total capital (non-owner occupied) , though this is common for community banks in Michigan.

Forward Catalysts

-

2026 accretion tailwind: $8M of scheduled interest income from purchased loan accretion provides earnings visibility

-

New Troy branch: Expansion into Southeast Michigan expected later in 2026

-

Tax credit purchases: Management is evaluating additional transferable tax credits to offset 2026 tax expense, following a $340K benefit in Q4

-

Operating leverage: With merger costs behind them, incremental revenue should flow more directly to the bottom line

Risks to Monitor

- NIM pressure: Continued Fed rate cuts may not immediately translate to deposit cost savings given already-low funding costs

- CRE concentration: 279% CRE-to-capital ratio warrants monitoring in a weakening commercial real estate environment

- NPL normalization: While management attributes the uptick to legacy PCD loans, the 0.98% NPL ratio bears watching

The Bottom Line

ChoiceOne delivered a clean beat in its first post-merger quarter without integration noise. The 94% YoY earnings growth reflects the scale benefits of the Fentura combination, while 7.6% annualized organic loan growth signals underlying franchise strength.

With merger expenses behind them and $8M in accretion income scheduled for 2026, the earnings profile looks more predictable. The key debate now shifts to NIM trajectory and whether organic growth can offset rate headwinds.

At $29.56 per share, COFS trades at roughly 1.0x tangible book value ($304M tangible equity / 15M shares = ~$20.29 TBV per share) — a reasonable multiple for a well-integrated community bank with mid-teens ROTCE.

Related Links: